Even before Michael Saylor dropped the now meme-immortalized phrase “there is no second best”, Bitcoin maximalism has been a staple of the crypto space. So much so that “crypto” itself became an unworthy moniker to describe Bitcoin’s weight and significance.

For Bitcoin maximalists, Bitcoin is Bitcoin and cryptos are altcoins, if not shitcoins. Now that Bitcoin is heading for a bull run, boosted by the 4th halving hype and Bitcoin ETF approvals, Saylor’s MicroStrategy is already over $1.2 billion in unrealized profit territory.

The Bitcoin meme maker himself wasted no time in visualizing the payoff from his Bitcoin maximalism strategy.

With such results on the table, it’s time to examine Bitcoin maximalism more closely. Is the simple holding of BTC tokens more sophisticated than all the altcoin derivative trading in the world?

The Core Beliefs Of Bitcoin Maximalism

At its core, Bitcoin maximalism is an extension of the first mover advantage. Having launched the Bitcoin mainnet in January 2009, the pseudonymous Satoshi Nakamoto put in motion a revolutionary proof of concept. Is it possible to establish peer-to-peer money in a secure manner?

Can a blockchain-based transfer and storage of wealth resist network manipulation? Satoshi made it so by cleverly combining cryptography with economic incentives. At its foundation lies Bitcoin’s proof-of-work algorithm. It makes network participants (miners) exert computational resources when adding new transaction data blocks.

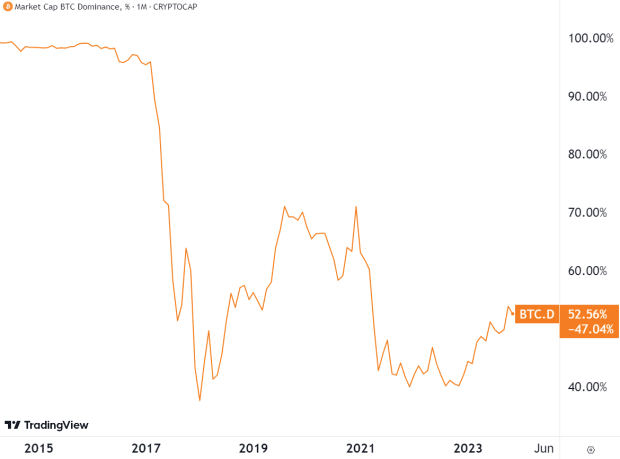

In return, miners are rewarded with BTC tokens, capped at 21 million. And because the state of the ledger has to be agreed upon by all miners, there is no single point of failure to exploit. It took until February 2017 for this groundbreaking concept to start churning altcoins, eroding Bitcoin’s market cap dominance.

With eight years under its belt to make people more comfortable with the novel concept, the rise of initial coin offerings (ICOs) diversified the crypto landscape. As one of the beneficiaries of this wave, Vitalik Buterin, the co-founder of Ethereum, equated Bitcoin maximalism with Bitcoin dominance maximalism.

“it is a stance that building something on Bitcoin is the only correct way to do things, and that doing anything else is unethical”

From this standpoint, the evolution and entrenchment of Bitcoin maximalism is predictable:

- First mover advantage leads to legitimization of blockchain-enabled wealth.

- From this process comes Bitcoin market cap dominance.

- Bitcoin market cap dominance leads to a more secure network.

- More secure P2P money network leads to greater public confidence.

- Greater public confidence leads to greater mass adoption.

- Greater mass adoption leads to greater BTC price, fortifying all the previous steps.

It is then easy to see how a flood of altcoins would have the potential to disrupt any of those stepping stones. Indeed, the very ICO craze in 2017 affirmed the idea that Bitcoin maximalism is righteous.

Namely, Satis Group conducted a study that found 78% of ICO projects as fraudulent. They were merely exit liquidity scams with project goals serving as bait. This was alongside 4% failed ICOs and 3% dead ICOs.

Yet, that finding was mild compared to the catastrophic culmination of crypto failures in 2022. Starting from Terra (LUNA), Celsius and Three Arrows Capital (3AC) to FTX, BlockFi and others, crypto enthusiasts suffered at least a $60 billion blow.

Not only did altcoins become suspect, but the entire corporate edifice attaching itself to blockchain networks did as well. In turn, these blows fed on each other, bringing Bitcoin price down to $16.5k, a price last seen in November 2020.

With public trust in “crypto” shaken, and an entire cycle effectively nullified, Bitcoin maximalists became even more eager to point out the founding virtues of Bitcoin – decentralization and self-custody.

Yet, even with these lessons behind us, does it make sense to prioritize Bitcoin above altcoins?

Economic Rationale Behind Bitcoin Preference

Bitcoin maximalists face a tough dilemma. There is only so much money to be poured into an asset, including Bitcoin. This is the market liquidity. Reaping the first mover advantage, Bitcoin has been the target of that pouring for at least a decade before this wave of thousands of altcoins were even born.

Now holding a $735 billion market cap weight, it is that much harder to gain more weight, i.e., a higher price. When the BTC price was over $50k, Bank of America calculated it would take $93 million net inflows to move its price by 1%.

This translates to greatly reduced percentage gains for new investors even if they fully understand Bitcoin’s status as a hedge against monetary debasement. Case in point:

- If one had bought 100 SOL in July 2021, they would have paid ~$2,500.

- By November 2021, their value ramped up to ~$25,000.

- Such 9x gains were only possible in early Bitcoin days when its market cap was low.

Even in the latest bullrun, without the Fed money supply element, Solana investors could have received 3x gains from October to November. The same dynamic is in play for a plethora of other altcoins and even memecoins.

With this in mind, Bitcoin maximalists adopt a distinctive approach, viewing Bitcoin as a key player in monetary evolution rather than a mere asset for short-term gains. Integral to this approach is aligning technical pattern analysis with long-term strategies to navigate Bitcoin’s market dynamics.

Philosophical Underpinnings Of Maximalism

Even for people who haven’t bought a single cryptocurrency token of any kind, the rapidly evolving blockchain space delivered valuable lessons in the public spotlight.

Previously reserved to the niche fringes of economic theory, concepts suddenly came to blockchain life: money supply, inflation rate, tokenomics, token allocation, vesting, burning, utility, governance.

It then became easy to extrapolate these mental models to the dollar itself. Applying tokenomics to USD, some Bitcoin enthusiasts even dubbed the dollar as “the ultimate shitcoin”.

- 1 node

- $2.3 trillion in circulation

- $33.75 trillion total supply (as owed to creditors)

- 1% of holders own 53% of equity (worth $19.16 trillion)

- Lost 94% of value over the last 100 years.

- Arbitrary supply tweaks, triggering rollercoaster inflations and recessions.

This is the new mental modeling that Bitcoin enabled, previously unavailable to the masses. For Bitcoin maximalists, the pioneering cryptocurrency represents the first viable alternative to a one-node (central banking) system. After all, Satoshi Nakamoto launched Bitcoin as a reaction to the central banks bailing out commercial banks with taxpayers’ money.

To either store or transfer wealth, people no longer have to ask for permission from anyone. More importantly, there is no central entity that can put its weight on the Bitcoin network and tweak its money supply. In turn, money can finally be truly private and serve as a savings vehicle.

In the long run, Bitcoin maximalism is all about not needing any off/on fiat ramps for Bitcoin. Rather, the Bitcoin standard would form a new decentralized monetary system. Auditable, transparent, and capped, they envision a system that terminates at the root the governmental penchant for corruption and wars.

In the meantime, as they currently stand in the debt-based monetary model, all fiat currencies incentivize risky investments to outpace inflation rates. While the Fed’s coveted inflation rate is 2%, Bitcoin is heading for under-1% inflation rate following the 4th halving in April 2024.

At this point, altcoin proponents may say, “but hundreds of altcoins have negligible inflation rates and capped coin supplies”. Bitcoin maximalists have a simple retort. Relying on a proof-of-work algorithm, Bitcoin is grounded in physicality, or as Michael Saylor put it, “digital energy”.

In practice, anyone can clone altcoins, which are then subject to capital (stake) network influence, accrued with more staking. Equally, one can clone open-source Bitcoin code. Yet, this is entirely irrelevant because Bitcoin is secured by networked energy, not capital. One leads to centralization, the other doesn’t.

Conclusion

Bitcoin is singular in its lack of attachment to any organization or personality. The same cannot be said of its oppositional altcoin army, starting with Ethereum. The cost of this decentralized resilience is paid in energy rather than capital stake. This has been the frictious source of countless articles and politicians’ remarks attacking Bitcoin’s use of energy.

Nonetheless, even these eco-oriented pressures seem to have lost steam. Can anyone truly tell what is the fair price for financial sovereignty? Looking at that horizon, Bitcoin maximalists are more focused on the escape from the central banking system rather than on short-term altcoin gains.

Although some maximalists view all altcoins as a wasteful distraction on that path, it is certain Bitcoin will be integrated in the altcoin ecosystem. At the end of the line, incentives create a blockchain landscape on their own regardless of opinions.

This is a guest post by Shane Neagle. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.