The below is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

The Chicago Board Options Exchange (CBOE), the largest US options exchange, has announced a move to open a new model of Bitcoin futures trading in 2024: A cryptocurrency-native exchange and clearinghouse that offers margin trading and leveraged derivatives among many planned products.

CBOE Digital announced these plans on November 13, sending ripples through the entire Bitcoin community with a radical list of planned features and trading options. The exchange is offering a wide array of products and services, so that users are not only able to directly invest in these futures contracts, but also to engage in multiple higher-risk methods of increasing their purchasing power. Margin trading involves using the assets in an account as collateral for a much larger loan from the exchange, to be invested in these futures trades, while leveraged trading allows a user to receive essentially a line of credit to magnify their position, taking gains and losses at several times the amount of their initial investment. CBOE plans to offer both of these functions.

These are only a few of the options outlined in their initial press release, as the exchange claimed to present “an intermediary-inclusive model” that “ensures separation of duties to avoid conflicts of interest,” and that CBOE’s capacity to serve as both exchange and clearinghouse “will allow it to potentially bring more unique and groundbreaking offerings in 2024.” The announcement also adds that their roadmap includes several physically delivered products, pending regulatory approval. By acting in this manner, ordinary investors will have a lower physical barrier to entry if they wish to gain exposure to Bitcoin, with the caveat that these margin and leverage options also come with an added risk.

Although CBOE’s plan to add these high-reward options to the world of Bitcoin futures trading is certainly a new experiment, the exchange’s history with this type of trading goes back quite far into Bitcoin’s history. CBOE was in fact the first options exchange in the world to offer Bitcoin futures trading back in December 2017 when it beat their Chicago-based rival CME to this milestone by 8 days. Although this particular period in crypto was heady with excitement, showing an unprecedented spike in Bitcoin’s price that wouldn’t be matched for several years, this rally wouldn’t last. Ed Tilly, then-CEO, claimed that “given the unprecedented interest in bitcoin, it’s vital we provide clients the trading tools to help them express their views and hedge their exposure,” but nevertheless this initial project was shuttered in 2019 during the bear market.

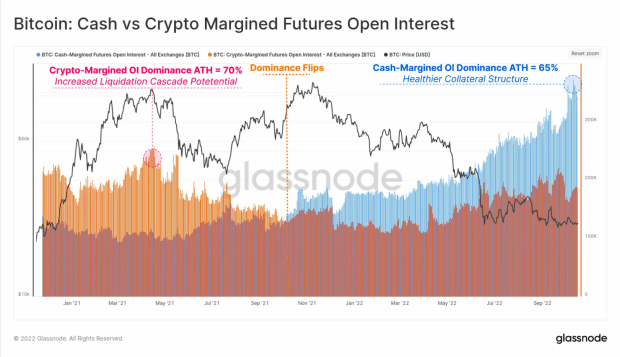

Still, although CBOE’s worldwide-first in Bitcoin futures trading couldn’t stay the distance, this actual type of Bitcoin exposure has proven very popular with the test of time. The Chicago Mercantile Exchange (CME) for example, which launched the second-ever futures trading program, has seen years of lagging interest turn into dramatic success. The CME has recently been enjoying a higher rate of Bitcoin futures trading than Binance, the world’s largest cryptocurrency exchange, in a development that commentators have called “a proxy for institutional activity.” It’s easy to see why there’s so much buzz around the subject: The impending Bitcoin ETF is frequently credited for Bitcoin’s success in late 2023, and the main point of interest is that a financial instrument like this would be an easy stepping-stone for a layperson to become financially entangled with the world’s premier digital asset. But, if rates of futures trading conducted in cash versus crypto are anything to go by, Bitcoin futures trading has also been doing this.

So, although CBOE ended their groundbreaking effort to pioneer Bitcoin futures trading, they’ve seen the action growing over the years, and have decided to dust off the project with some new and expanded functionality. They gained regulatory approval from the Commodities and Futures Trading Commission (CFTC) in June to carry out these revolutionary product offerings, and they’ve been off to the races ever since. CBOE Digital’s President John Palmer claimed at the time that margin trading is a “big driver” of derivatives trading worldwide, and added that “we’re always taking a very prudent approach to products that we list in the spot and derivatives markets.”

To facilitate a smooth launch for these new services, CBOE has entered into partnerships with several different leaders in the intersection of digital assets and finance, including B2C2, BlockFills, CQG, Cumberland DRW, Jump Trading Group, Marex, StoneX Financial, Talos, tastytrade, Trading Technologies and Wedbush. Palmer told the press that “our upcoming launch of margin futures represents a significant milestone for CBOE Digital, and we are grateful to have the support of such a remarkable group of industry partners who share our commitment to building trusted and transparent crypto markets. We couldn’t be more excited,” he added, “to extend access to [futures] further into the digital assets markets and offer margin trading for our customers.”

The new regime of futures trading at CBOE is currently scheduled to open on January 11, 2024. Depending on its success and possible breakthroughs in regulatory approval, new features may be added in the following months. However, although CBOE has also announced that Ether futures will also be available alongside Bitcoin ones, Palmer firmly stated that there are “no plans in sight” that any altcoins will be added any time soon.

The Bitcoin community is waiting with bated breath to see how well these futures trades perform come January. Although margin and leverage trading does include the potential for increased losses and is not for the faint of heart, it doesn’t change the fact that the vastly decreased amounts of cash up front required to invest are a major draw. If the Bitcoin ETF is set to turn total novices into Bitcoiners, with things as mundane as pension funds suddenly tied up with Bitcoin, then this margin futures trading is set to have the smallest private traders to jump in headfirst.

As it stands today, the existing Bitcoin futures trading is already a substantial industry, and CBOE is betting that these riskier options will leave all sorts of traders looking for the action. Although Bitcoin’s main goal is to turn existing financial models on their head, it can’t be denied that the marriage of Bitcoin and finance has paid out massive dividends in increasing Bitcoin’s popularity and value. If CBOE can set a trend in the industry for the second time on Bitcoin futures trading, a whole world of opportunities will open up.