Ether (ETH) futures are more popular than ever, following the sudden, positive turnaround in sentiment concerning the potential approval of spot ETH exchange-traded funds (ETFs) in the U.S.

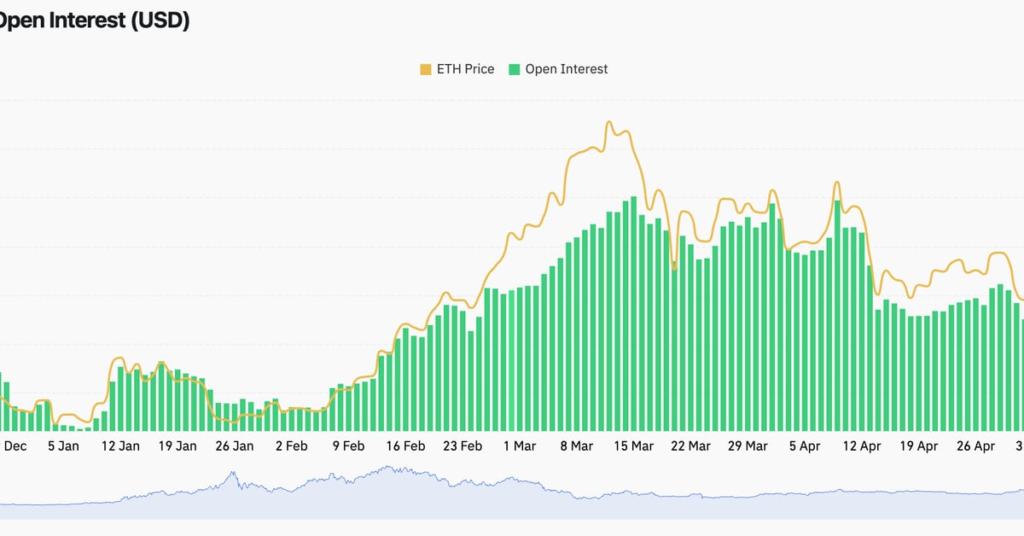

Notional open interest, or the dollar value locked in the number of active ether futures contracts, climbed 25% to a record $14.05 billion in the past 24 hours, according to data source Coinglass. The previous lifetime peak of $13.2 billion dates back to March 15.

The increase is a sign of a renewed influx of money into the ether market, mainly on the bullish side, as the second-largest cryptocurrency by market cap added almost 19% to $3,680, according to CoinDesk data. The uptick in open interest alongside a price rise is said to confirm the uptrend.

Late Monday, Bloomberg’s ETF analysts increased the probability of the U.S. Securities and Exchange Commission (SEC) green lighting the spot ETH ETFs to 75% from 25%. Meanwhile, CoinDesk reported that the SEC had asked exchanges looking to list and trade potential spot ether ETFs to update 19b-4 filings on an accelerated basis, a sign of the regulator attempting to fast-track the process.

See also: U.S. Senate Votes to Kill SEC’s Crypto Accounting Policy, Testing Biden’s Veto Threat

Since then, the crypto community on X is speculating that the SEC might lean in favor of approving a spot ETH ETF, potentially signaling a broader constructive regulatory outlook toward crypto.

The regulator is scheduled to make a decision on the VanEck spot ether ETF on May 23. The SEC must approve the 19b-4 filings and the S-1 registration statements for ether ETFs to commence trading on stock exchanges.