One of the central value propositions of Bitcoin is that no matter what happens, if you pay a high enough fee some miner out there in the world will confirm your transaction. In other words, Bitcoin is censorship resistant. There is a very good reason that the phrase “censorship resistant” is the wording you hear whenever this topic comes up, not “censorship proof.” Any individual miner can censor whatever they want, in the sense that they can refuse to include something in any block they mine themselves. They cannot, however, prevent other miners from including that transaction in their own blocks whenever they find one.

Bitcoin is resistant to censorship, but it is not immune to it. Any miner can censor whatever they want, and that is free, ignoring of course the potential opportunity cost of revenue loss if there are not enough transactions available paying a comparable feerate to the transaction(s) they choose to censor. But this doesn’t stop the global system from processing that transaction anyway, unless those miners 1) comprise a majority of the entire network hashrate, 2) choose to leverage that reality to orphan the block of any miner who chooses to process the transaction(s) they wish to censor.

To do this would lose the majority of miners engaging in the orphaning attack money as long as the minority set of miners continued mining blocks that included the “verboten” transaction. Each time such a block was found, it would essentially increase the time until the next block that made it into the chain was found, lowering the majority of censoring miners’ income on average. This would remain the case until the minority gave up and capitulated or was run out of business (as they would be forgoing revenue on any block including the censored transaction as well).

For now, let’s assume that this scenario is not in the cards. If it were, Bitcoin is either a failure, or must exist in this state until non-censoring miners are able to quietly amass enough hashrate in order to overpower the current majority intent on orphaning blocks containing transactions they do not want confirmed in the blockchain.

So what happens when a set of miners, in the minority, decide they are going to censor a specific subset of transactions from their blocks? The amount of blockspace that is available to those transactions shrinks. There is less blockspace available to them than every other class of transactions. What is the end result of this? Fee pressure for this class of transactions will hit saturation faster than every other class of transactions.

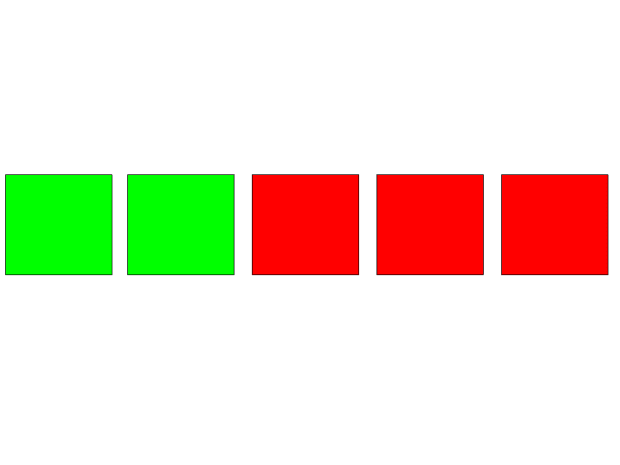

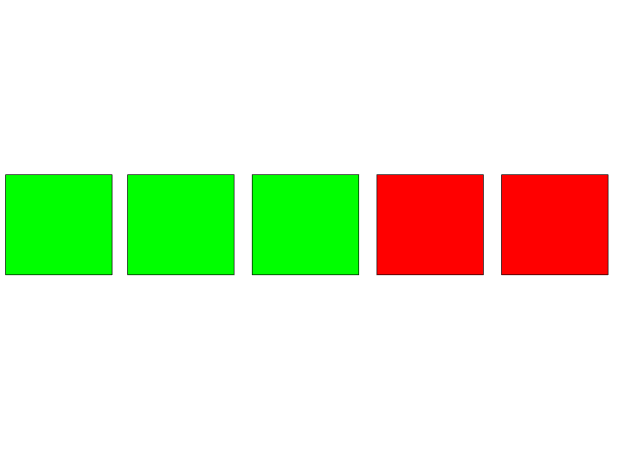

Just for the sake of simplicity in the example, imagine it only takes 10 transactions to fill up any given block. We’ll call regular transactions simply “regular transactions”, and the transactions being censored “verboten transactions.” Each day there are on average five blocks found, and there are five miners. The red blocks represent miners who will not mine verboten transactions, and the green blocks are miners who will. For regular transactions to saturate the available blockspace and start driving up fees, there needs to be 50+ transactions pending in order for the bidding frenzy to begin driving up fees and increasing the revenue for miners. At this point the fee generated revenue for all miners will begin increasing.

For the verboten transactions, only 20+ transactions need to be pending in order for a bidding frenzy to begin amongst them, driving up fee revenues. But the fee revenue from the verboten transactions will only be collected by the green miners.

In a situation where the verboten transactions are not saturating mempools in excess of the block capacity available to them, all miners will make the same rough level of income. Those verboten transactions must compete with regular transactions in order to have some guarantee of timely confirmation, so if regular transactions are saturating the mempool but verboten transactions are not the overall fee pressure will be relatively evenly distributed amongst all miners and no one will have any disproportionate fee revenue unavailable to the others.

However, if verboten transactions are saturating the mempool in excess of the available blockspace, that fee pressure will drive up fees paid by verboten transactions only for the green miners. Having elected to censor these transactions, red miners will not be realizing any increased fee revenue from the verboten transactions. Regular transactions in this scenario will not have to compete with verboten transactions in feerates unless they need to confirm in the next block, so the indirect feerate rise in regular transactions because of verboten transactions’ fee pressure will not lead to an equivalent increase in revenue for red miners.

This disequilibrium leaves green miners earning more revenue per block/hash than red miners. This is, incentivize wise, obviously unsustainable. One of two things will happen over time: 1) either the green miners will reinvest the extra revenue they are acquiring and expand their percentage of the hashrate, or 2) miners will defect from the red side and the green set of miners will grow in percentage of the hashrate that way.

This dynamic of higher fees for green miners will result in the growth of the hashrate of green miners, regardless of whether through reinvestment or defection from red miners, until it reaches an equilibrium where the verboten transactions’ blockspace demand levels off with regular transactions, and both groups of miners are making roughly the same income. This equilibrium will last until the verboten transactions’ demand for blockspace exceeds that available to them, and then the entire dance of green miners earning more until they grow in network hashrate share to an equilibrium point of equal fee revenue again.

This dynamic is why Bitcoin is censorship resistant. Not because all miners are not capable of censoring something, but because miners are incentivized to include something other miners are censoring through market dynamics. If some miners censor a class of transactions, they decrease the amount of blockspace available to them and drive up the fees they are willing to pay. Pure and simple. Unless miners are completely irrational, in which case Bitcoin’s entire security model is called into question, some will include these transactions and earn the extra revenue.

Comments are closed.